Does insurance cover hair loss? It’s one of the most common concerns for people facing sudden or chronic hair thinning. Whether it’s due to medical treatment, stress, or genetics, hair loss can affect your confidence—and your wallet. Insurance policies rarely make things simple. In this guide, we’ll explain what’s typically covered, what’s not, and how …

Does insurance cover hair loss? It’s one of the most common concerns for people facing sudden or chronic hair thinning. Whether it’s due to medical treatment, stress, or genetics, hair loss can affect your confidence—and your wallet.

Insurance policies rarely make things simple. In this guide, we’ll explain what’s typically covered, what’s not, and how to navigate your insurance plan to increase your chances of approval. You’ll also learn about real costs, expert insights, and what steps to take if your claim gets denied.

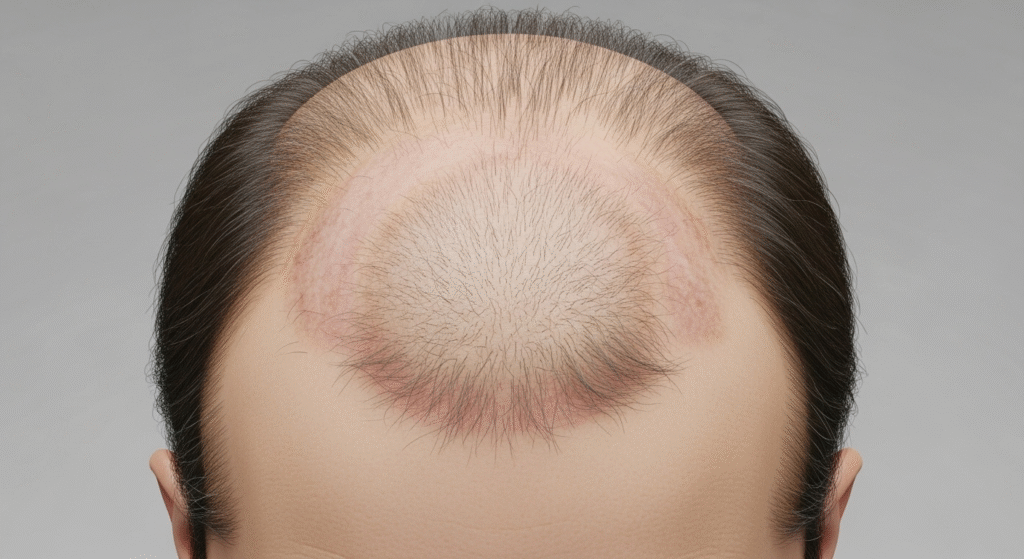

Understanding Hair Loss as a Medical vs. Cosmetic Issue

Before diving into your insurance policy, it’s important to understand how insurers view hair loss.

What Causes Hair Loss?

Hair loss can be triggered by:

- Medical conditions (e.g., alopecia areata, lupus)

- Hormonal imbalances

- Nutritional deficiencies

- Stress or trauma

- Chemotherapy or radiation

When Is Hair Loss Considered Medical?

If hair loss is linked to a diagnosed medical condition or treatment (like cancer therapy), it’s more likely to be seen as medically necessary—which increases chances for insurance coverage.

Why Most Insurers Label Hair Loss as Cosmetic

In most other cases, such as male or female pattern baldness, insurers label treatments as “cosmetic” rather than “essential.” This distinction means they often deny coverage unless the hair loss stems from a medical issue.

Does Insurance Cover Hair Loss? The Short Answer

Insurance may cover hair loss treatments, but only under specific conditions.

When Coverage Is Possible

- Hair loss due to chemotherapy or radiation

- Autoimmune disorders like alopecia areata

- Burn injuries or scalp trauma

- Certain mental health conditions (trichotillomania, under medical care)

Common Exclusions

- Androgenetic alopecia (male/female pattern baldness)

- Cosmetic hair transplants

- PRP therapy, unless medically prescribed

Real-Life Coverage Example

Some U.S. states require private insurers to cover cranial prosthetics (medical-grade wigs) for patients undergoing chemotherapy.

Treatments That May Be Covered by Insurance

Not all hair loss treatments are excluded. Here are a few that might be covered under certain plans:

Wigs or Cranial Prosthetics

- Covered in some states when prescribed by a physician

- Must be coded correctly (e.g., HCPCS code A9282)

Prescription Medications

- Minoxidil (Rogaine): Rarely covered unless part of a larger treatment plan

- Finasteride: May be covered for prostate treatment but not hair loss

Dermatology Consults & Testing

- Blood tests to determine cause of hair loss

- Biopsies or scalp analysis

What Insurance Usually Doesn’t Cover

Understanding limitations will help you avoid surprise expenses.

Hair Transplants & PRP Therapy

- Considered elective and typically not reimbursed

- Even if hair loss is due to illness, transplants remain cosmetic in most policies

Supplements and OTC Products

- Collagen, biotin, and hair-growth vitamins aren’t eligible for reimbursement

- Specialty shampoos and conditioners also excluded

Laser Devices and Cosmetic Treatments

- Laser caps or combs, despite some clinical support, are not usually covered

How to Improve Your Chances of Insurance Coverage

Even if your case is borderline, these steps may increase approval odds.

1. Obtain a Medical Diagnosis

- A dermatologist or general physician must diagnose your condition.

- Documentation should specify the underlying medical necessity.

2. Check Your Policy Language

- Look for terms like “cranial prosthetics,” “dermatologic care,” or “medically necessary.”

3. File an Appeal if Denied

- Many initial claims are denied but later approved after proper documentation

- Include a Letter of Medical Necessity and supporting records

Insurance Types and Their Impact on Hair Loss Coverage

Private Health Insurance

- Coverage varies widely by plan

- Some employer-sponsored plans are more comprehensive

Medicaid / Medicare

- Generally do not cover cosmetic treatments

- May cover diagnostic testing if hair loss is symptom-related

Employer-Sponsored Insurance

- May offer wellness or supplemental benefit packages

- Some include limited PRP or dermatology reimbursement

International Coverage

- Coverage rules vary; some countries include cranial prosthetics as a basic benefit

Expert Advice on Navigating Hair Loss Insurance

Real-World Case Study

- Patient undergoing radiation for cancer received approval for wig reimbursement after submitting physician prescription and cost breakdown

Questions to Ask Your Insurer

- Is hair loss treatment covered under any condition?

- What documentation is required for wigs or topical treatments?

- Can I get pre-authorization before starting treatment?

Cost Comparison: With vs. Without Insurance

| Treatment Type | Average Cost (Out-of-Pocket) | With Insurance |

|---|---|---|

| Medical Wig | $600–$1,200 | Often Fully Covered |

| PRP Therapy (3 sessions) | $1,500–$3,000 | Not Covered |

| Dermatologist Consult | $150–$300 | Often Covered |

| Minoxidil/Finasteride | $20–50/month | Occasionally Covered |

Can You Rely on Insurance for Hair Loss Treatment?

Insurance coverage for hair loss is complex, inconsistent, and heavily dependent on the cause of your condition. While cosmetic cases like pattern baldness are rarely covered, medically linked hair loss often qualifies for support. From wigs to consultations, partial reimbursement is possible—but you’ll need to advocate for yourself with documentation and persistence.

FAQs

Does insurance cover alopecia areata treatment?

Yes, in many cases. If diagnosed and documented, insurance may cover medication, consultations, and wigs.

Can insurance pay for chemotherapy-related hair loss?

Yes, especially for cranial prosthetics (wigs). Pre-approval and a physician’s prescription are usually required.

Will PRP therapy ever be covered by insurance?

Unlikely. PRP is still categorized as experimental or elective by most insurers.

How do I file an insurance claim for hair loss treatment?

Sometimes. OTC Minoxidil is not covered, but prescription-based versions might be under select plans.

Take the Next Step Toward Hair Recovery

Still unsure about your insurance options for hair loss? Get expert assistance today.

Book a consultation with Dr. Uzma Irfan, an ISHRS-certified surgeon in Islamabad to explore your personalized treatment and insurance eligibility plan. We’ll help you identify covered services, draft appeal letters, and plan for cost-effective recovery.